Working Papers

- Institutional Reaching for Duration and Equity Term Premium, Job Market Paper [Paper] (February 2025)

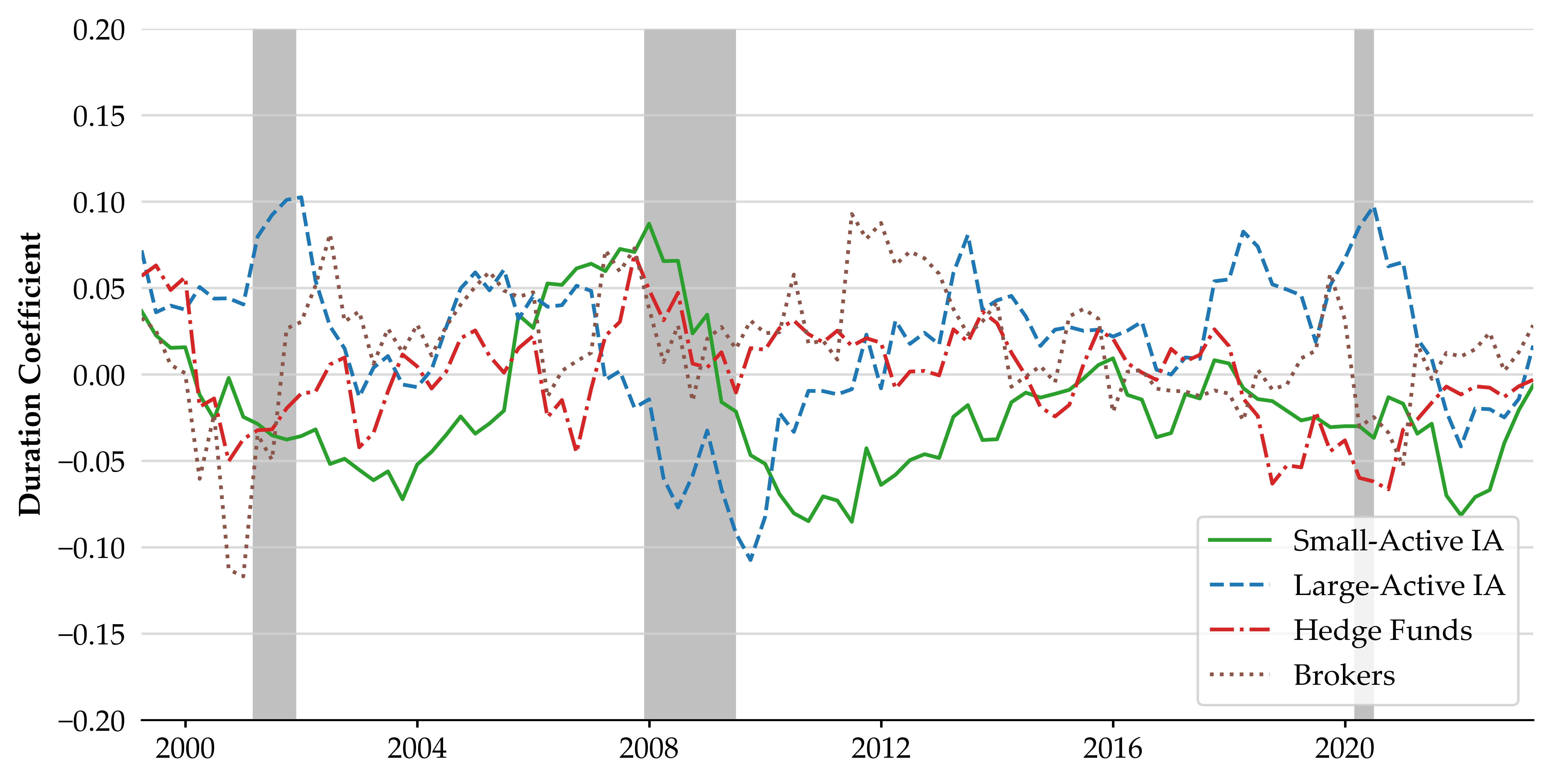

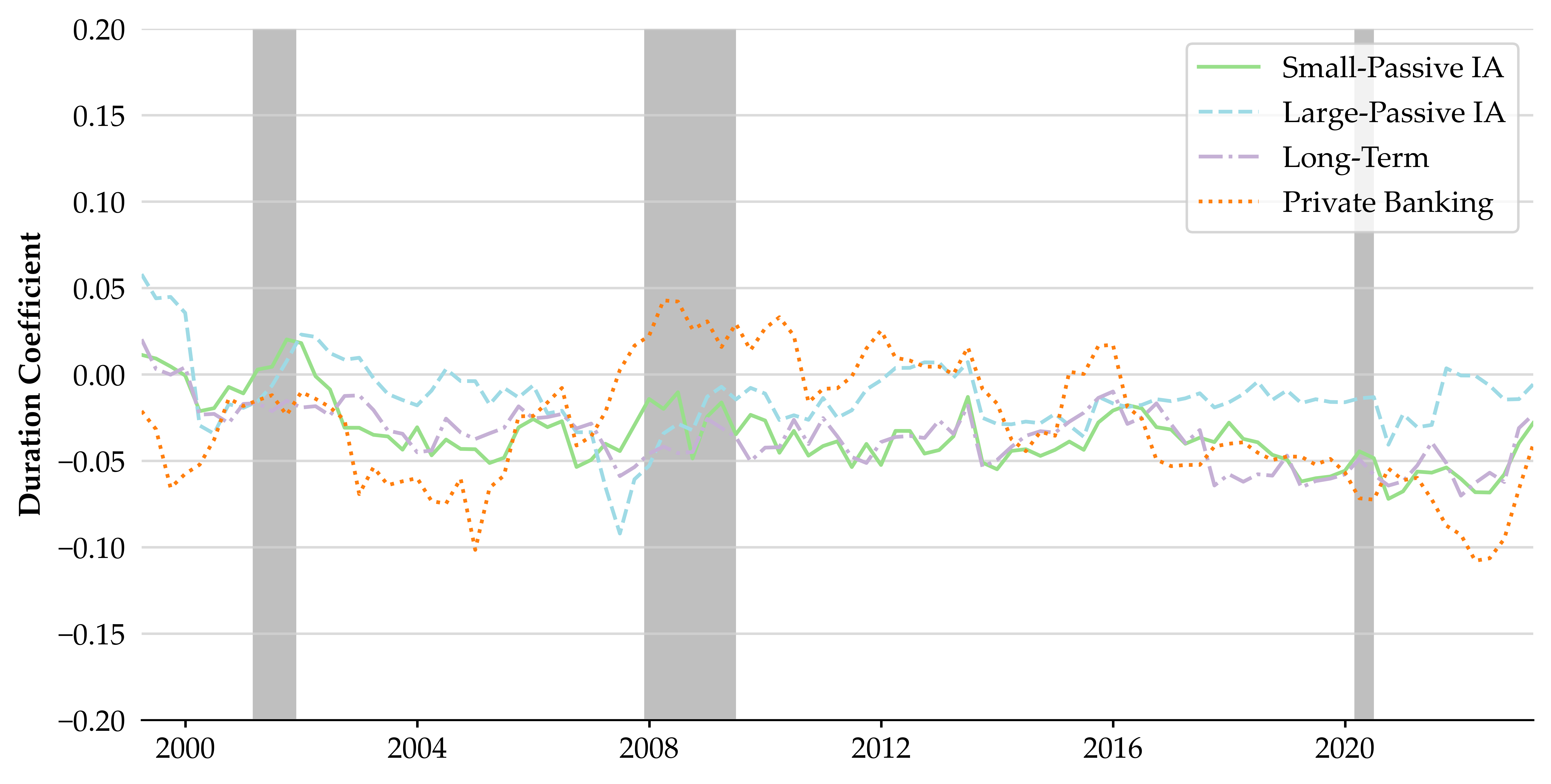

- Active institutions reach for long-duration stocks during economic booms and sharply tilt away during recessions, while passive institutions eschew market timing by consistently holding short-duration stocks.

- Stock-level duration demand significantly responds to its long-term earnings growth forecasts, which are shown to be excessively optimistic. As these beliefs are systematically disappointed, stocks heavily held by institutions that reach for duration have lower returns in the long run.

- Institutional reaching for duration significantly reduces firms' cost of capital and encourages equity issuance, contributing to the cyclical investment patterns of short- and long-duration firms.

- Green Price Pressure with Don Noh, Sangmin Oh, and Sean Shin (February 2025)

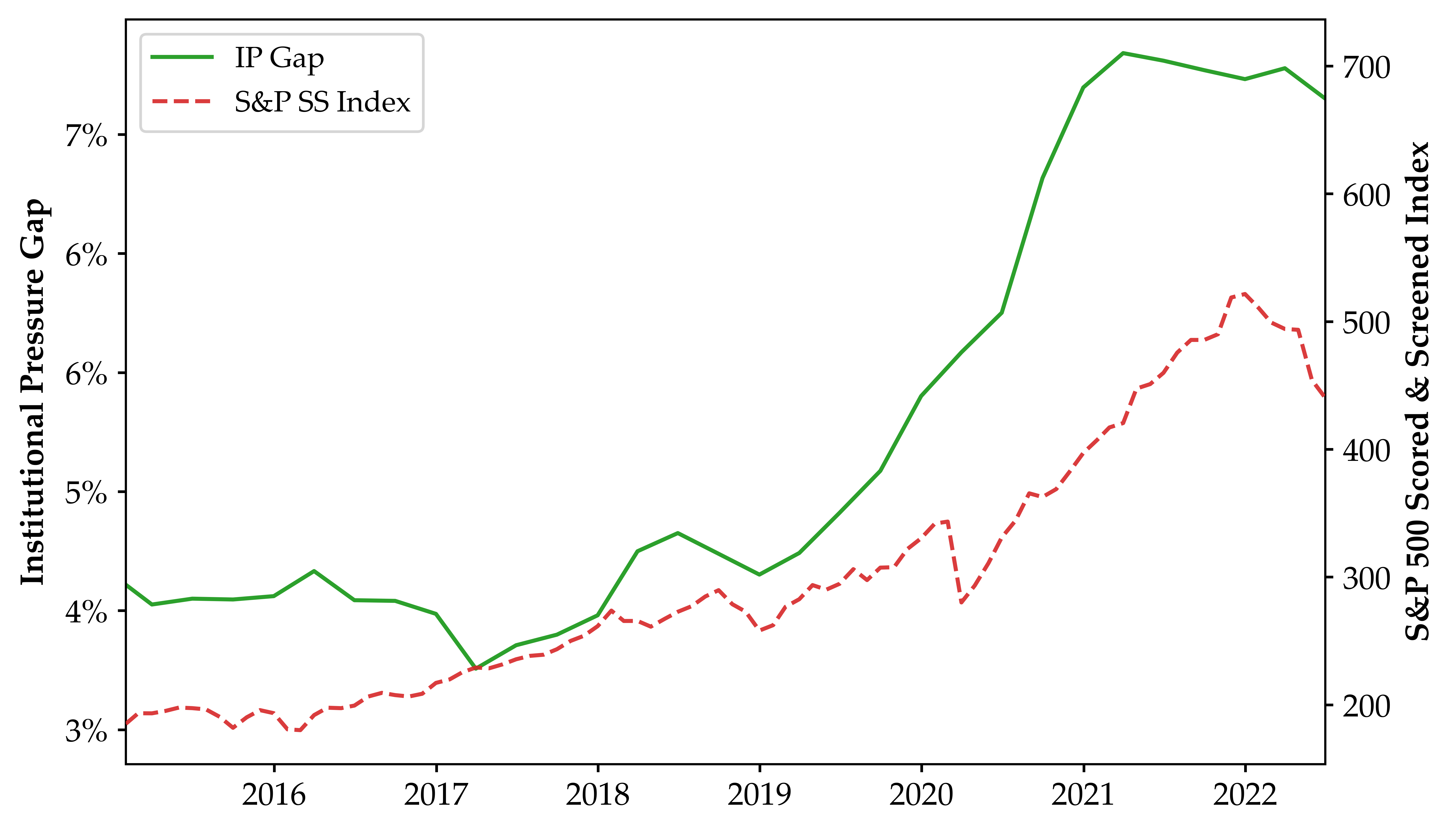

- Growing investor demand for sustainable firms can incentivize firms to improve their environmental performance by changing their stock prices.

- We develop a new measure capturing this pressure at the firm-level and show that it has increased significantly since 2016 for both green and brown firms.

- Our findings suggest that sustainable investing, when accounting for investor heterogeneity and realistic demand elasticities, can generate sufficient price pressure to influence corporate behavior towards sustainability.

Active Institutions

Passive Institutions

Cumulative Wealth of RFD Strategy (start from $1 in 2007:Q4)

Institutional Pressure Gap and S&P SS Index